All Categories

Featured

Table of Contents

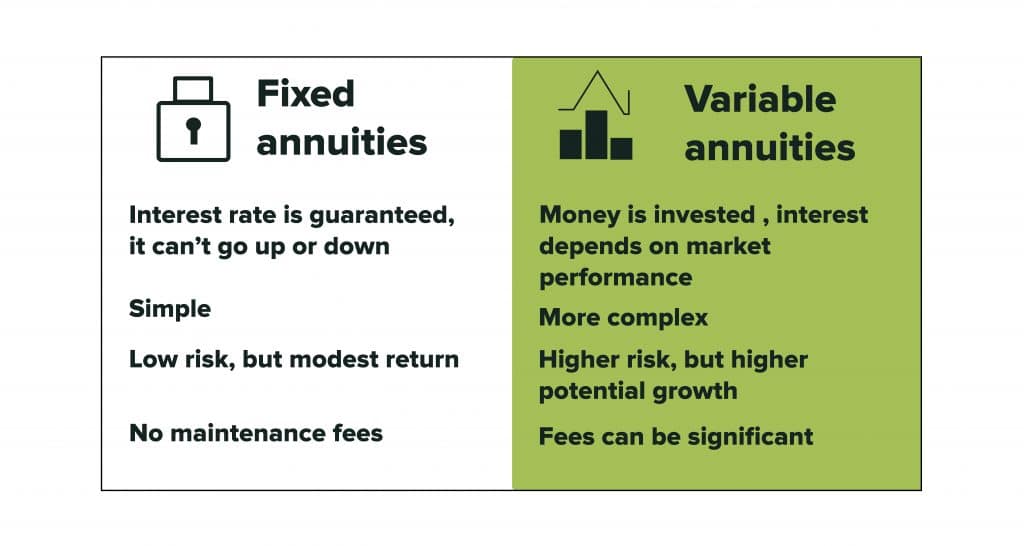

Variable annuities are a kind of investment income stream that climbs or falls in value occasionally based on the marketplace efficiency of the financial investments that money the revenue. A capitalist that picks to produce an annuity may choose either a variable annuity or a fixed annuity. An annuity is a monetary item offered by an insurer and readily available through banks.

The taken care of annuity is a different to the variable annuity. The worth of variable annuities is based on the performance of an underlying profile of sub-accounts picked by the annuity owner.

Fixed annuities provide a guaranteed return. Variable annuities supply the opportunity of greater returns yet likewise the risk that the account will certainly fall in worth. A variable annuity is created by a agreement contract made by a financier and an insurer. The investor makes a round figure payment or a series of payments gradually to fund the annuity, which will start paying out at a future day.

The settlements can proceed for the life of the capitalist or for the life of the investor or the capitalist's making it through partner. It also can be paid in a set number of settlements. One of the various other significant choices is whether to set up for a variable annuity or a taken care of annuity, which sets the quantity of the settlement in breakthrough.

Sub-accounts are structured like common funds, although they do not have ticker icons that investors can easily use to track their accounts.

, which start paying revenue as soon as the account is fully moneyed. You can buy an annuity with either a swelling amount or a series of repayments, and the account's value will grow over time.

Exploring Fixed Vs Variable Annuities A Closer Look at Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Variable Annuities Vs Fixed Annuities Why Tax Benefits Of Fixed Vs Variable Annuities Is Worth Considering How to Compare Different Investment Plans: Explained in Detail Key Differences Between Annuity Fixed Vs Variable Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

The 2nd phase is caused when the annuity owner asks the insurance company to start the circulation of revenue. Variable annuities must be taken into consideration lasting investments due to the limitations on withdrawals.

Variable annuities were introduced in the 1950s as an option to dealt with annuities, which provide a guaranteedbut commonly lowpayout during the annuitization phase. (The exception is the set income annuity, which has a modest to high payout that climbs as the annuitant ages). Variable annuities like L share annuities provide financiers the possibility to increase their annuity earnings if their investments grow.

The advantage is the opportunity of greater returns during the build-up stage and a bigger income during the payment stage. The drawback is that the buyer is subjected to market risk, which can suggest losses. With a taken care of annuity, the insurance coverage firm thinks the risk of supplying whatever return it has actually guaranteed.

a few other sort of financial investment, it deserves weighing these pros and disadvantages. Pros Tax-deferred growth Revenue stream customized to your demands Guaranteed fatality benefit Funds off-limits to lenders Disadvantages Riskier than taken care of annuities Surrender fees and fines for early withdrawal High costs Below are some information for each side. Variable annuities expand tax-deferred, so you don't need to pay tax obligations on any type of investment gains till you start obtaining income or make a withdrawal.

You can tailor the revenue stream to suit your demands. Variable annuities are riskier than taken care of annuities because the underlying financial investments might lose worth.

Any withdrawals you make prior to age 59 may go through a 10% tax penalty. The costs on variable annuities can be fairly significant. An annuity is an insurance policy item that assures a collection of settlements at a future date based on a quantity deposited by the investor. The releasing business invests the cash until it is paid out in a series of repayments to the capitalist.

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is a Smart Choice Fixed Annuity Vs Equity-linked Variable Annuity: How It Works Key Differences Between Variable Annuity Vs Fixed Annuity Understanding the Risks of Fixed Vs Variable Annuities Who Should Consider Fixed Income Annuity Vs Variable Annuity? Tips for Choosing Fixed Interest Annuity Vs Variable Investment Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Vs Fixed Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at Immediate Fixed Annuity Vs Variable Annuity

Variable annuities have greater capacity for revenues growth however they can also shed money. Fixed annuities usually pay out at a lower yet stable price contrasted to variable annuities.

No, annuities are not insured by the Federal Deposit Insurance Coverage Corp. (FDIC) as they are not bank products. They are safeguarded by state guaranty associations if the insurance policy business supplying the product goes out of organization.

Bear in mind that between the many feessuch as investment management charges, mortality charges, and management feesand fees for any extra cyclists, a variable annuity's expenses can rapidly include up. That can adversely affect your returns over the long-term, compared with various other kinds of retired life financial investments.

, that permit for consistent repayments, rather than those that rise and fall with the marketwhich appears a whole lot like a repaired annuity. The variable annuity's underlying account balance still alters with market performance, perhaps affecting how lengthy your payments will last.

There are two main types of annuities: fixed and variable. Variable annuities will lug more threat, while fixed annuities normally supply affordable rate of interest prices and restricted risk.

American Fidelity guarantees both the principal and rate of interest on our dealt with agreements and there is an ensured minimum rate of rate of interest which the agreement will certainly never pay less than, as long as the contract is in force. This contract enables the possibility for higher returns on financial investments over the lengthy term by enabling the proprietor the capability to invest in different market-based profiles.

Understanding Financial Strategies Key Insights on Your Financial Future What Is the Best Retirement Option? Features of Pros And Cons Of Fixed Annuity And Variable Annuity Why Fixed Annuity Vs Equity-linked Variable Annuity Can Impact Your Future Variable Annuities Vs Fixed Annuities: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Annuities Fixed Vs Variable FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

At The Annuity Specialist, we understand the intricacies and psychological stress of planning for retirement., and retirement coordinator.

Whether you are risk-averse or seeking higher returns, we have the proficiency to direct you through the subtleties of each annuity kind. We acknowledge the stress and anxiety that includes monetary uncertainty and are below to supply clarity and confidence in your investment decisions. Begin with a complimentary consultation where we analyze your monetary goals, risk resistance, and retired life demands.

Shawn is the owner of The Annuity Expert, an independent on the internet insurance coverage firm servicing customers throughout the United States. Through this system, he and his team goal to get rid of the uncertainty in retired life planning by assisting people discover the most effective insurance coverage at the most affordable rates. Scroll to Top.

This premium can either be paid as one swelling sum or distributed over a duration of time. The cash you contribute is invested and after that eligible for routine withdrawals after a deferral duration, depending upon which annuity you choose. All annuities are tax-deferred, so as the worth of your agreement grows, you will certainly not pay tax obligations up until you receive income payments or make a withdrawal.

Analyzing Strategic Retirement Planning Everything You Need to Know About Choosing Between Fixed Annuity And Variable Annuity What Is Fixed Index Annuity Vs Variable Annuities? Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is Worth Considering What Is Variable Annuity Vs Fixed Annuity: How It Works Key Differences Between Fixed Index Annuity Vs Variable Annuities Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Index Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Pros And Cons Of Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Vs Variable Annuities A Closer Look at How to Build a Retirement Plan

Regardless of which choice you make, the cash will be rearranged throughout your retired life, or over the duration of a picked time period. Whether a round figure payment or numerous premium repayments, insurer can offer an annuity with a collection passion rate that will certainly be attributed to you over time, according to your agreement, referred to as a set rate annuity.

As the value of your dealt with rate annuity expands, you can continue to live your life the method you have actually always had prepared. There's no demand to stress over when and where money is coming from. Repayments correspond and assured. Make certain to talk to your economic consultant to determine what sort of fixed price annuity is appropriate for you.

This gives you with assured revenue earlier instead of later. You have alternatives. For some the instant option is a required choice, however there's some versatility here too. While it may be made use of promptly, you can likewise postpone it for up to one year. And, if you delay, the only portion of your annuity considered taxable earnings will be where you have actually built up passion.

A deferred annuity permits you to make a swelling sum payment or a number of settlements gradually to your insurer to provide revenue after a collection duration. This duration enables the passion on your annuity to grow tax-free prior to you can accumulate settlements. Deferred annuities are normally held for about twenty years before being eligible to get payments.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Breaking Down the Basics of Pros And Cons Of Fixed Annuity And Variable Annuity Pros and Cons of Pros And Cons Of Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Annuity Vs Variable Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing the Best Investment Strategy FAQs About Variable Vs Fixed Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Annuities Vs Fixed Annuities

Because the rate of interest is dependent upon the performance of the index, your cash has the possibility to grow at a different rate than a fixed-rate annuity. With this annuity plan, the rates of interest will never ever be much less than zero which suggests a down market will not have a significant adverse influence on your revenue.

Much like all investments, there is possibility for risks with a variable rate annuity. There is likewise excellent possible for development that might provide you with required adaptability when you start to get payments. Annuities are an excellent way to obtain a "retired life paycheck" when you pick to clear up down at the end of your job.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Annuity? Features of Smart Investment Choices Why Choosing the Right Financial Strat

Understanding Deferred Annuity Vs Variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Fixed Income Annuity Vs Variable Annuity Why Cho

Breaking Down Variable Vs Fixed Annuities Everything You Need to Know About Financial Strategies What Is Variable Annuities Vs Fixed Annuities? Benefits of Fixed Income Annuity Vs Variable Growth Annu

More

Latest Posts